5D's Capital Partners

Achieve your financial goals with Multifamily Real Estate Investments

5D's Capital Partners

Achieve your financial goals with Multifamily Real Estate Investments

Let us prove to you how we put your money to work for you.

5D's Capital Partners acquires and manages multifamily properties that deliver consistent, high yield returns for its investor partners. See how Multifamily Real Estate Investing can change your life

Why Multifamily Real Estate

Cash Flow

Investors receive quarterly distributions after all expenses have been paid.

Stability

Multifamily investments are less volatile than traditional stock-based investments and continue to outperform them.

Tax Benefits

Depreciation allows you to keep more profit by reducing your tax burden.

Leverage

You can leverage real estate, this allows you to buy a $10M property with only $2.5M.

Amortization

The equity created by residents as they pay down the debt, creates long-term wealth.

Appreciation

Strategic value plays and forced appreciation increase the property's overall value.

Add Multifamily Real Estate To Your Portfolio

WHY INVEST WITH US?

Investment Type

Let us help you grow your wealth through passive, value add Multifamily Real Estate investments.

Target

Returns

Each investment opportunity has its own financial breakdown but we typically aim for a 15 - 20% internal rate of return.

Time

Frame

When we find the right opportunity, we typically hold the investment between 3 to 5 years.

Cash

on Cash

We average a 7-10% Cash on Cash for our investment opportunities.

Investor Relations

Our team will provide investors with monthly updates on the progression of their investment

Process

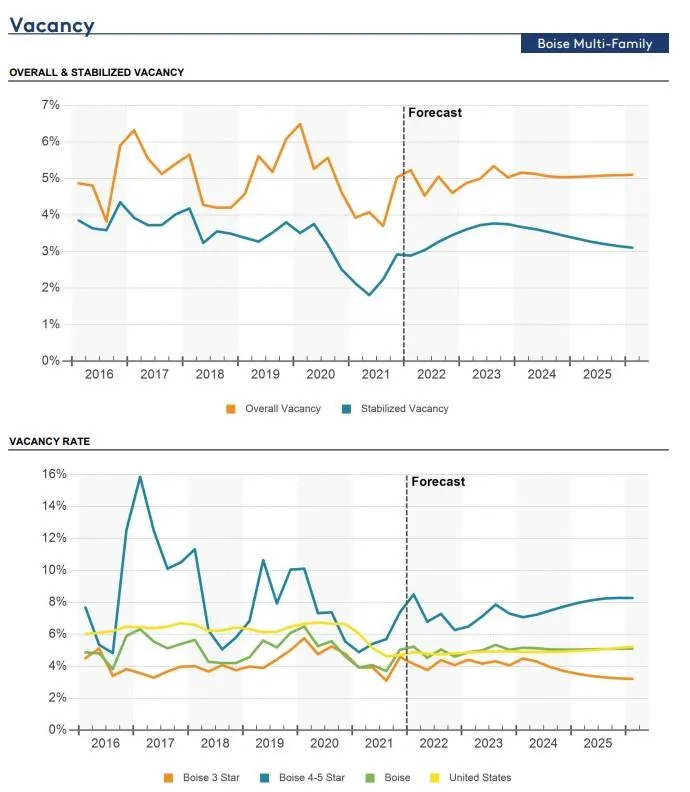

Market Research

We carefully evaluate supply and demand, demographics, historical performance, and other market conditions to identify high growth, supply constrained markets. Careful evaluation of macro and micro economic cycles ensure that the investment will perform as conditions inevitably change. We spend countless hours putting this data to work, determining the best market for our investments.

Deal Sourcing

Our team utilizes our relationships with local and National Brokers, Lenders, and other market participants to gain superior information that is not available to the market at large. We develop strong relationships within each market, provide specific criteria, and most importantly, we prove to our contacts that we can CLOSE. When it comes down to it, that is what they value most.

Analysis

Analyzing the deals that come across our desk is one of the most important pieces of the puzzle. We have institutional grade underwriting tools that allow us to vet deals with precise detail, in record time. This means we can confidently prepare a business plan that is unique to each property's needs, and provide our investor partners the gritty details, if they so desire.

Due Diligence

Investors don't usually like getting into each unit, detailing the deferred maintenance, or coordinating with the local contractors and surveyors. That's where we come in. Our team loves getting into the weeds with due diligence, using a thorough 50+ point checklist that ensures we know EXACTLY what we are getting into.

Acquisition

Our team closes the gap on closing. From negotiating the Purchase Sales Agreement, to coordinating delivery and execution of closing documents. Our team has it all covered so investors just have to worry about where to wire their funds.

Value Add

Our team specializes in value-add properties. We use multiple value-add initiatives and implement operational improvements to drive greater profitability through rent growth and increase tenant occupancy which allows us to achieve the highest possible appreciation.

Asset Management

We have developed a tried-and-true business plan that consistently delivers properties which foster strong communities, and dependable tenants. Our team partners with local property management companies to ensure our plan is executed as intended.

Financial Stewardship

Our focus is to increase Net Operating Income (NOI) and distributable cash flow every year. Through NOI growth, we can increase the value of your investment year over year to reach our exit strategy. We offer our investors financial transparency with access to an online portal that is user-friendly.

STAY CONNECTED

Sign up to receive 5D's Capital Partners news, opportunities, and other updates.

Connect

Learn more about how we manage Multifamily Real Estate Investments

About

- Lake Oswego Oregon 97034

- 5DsMultifamily@gmail.comSend us an Email

No Offer of Securities—Disclosure of Interests Under no circumstances should any material at this site be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they can evaluate the merits and risks of prospective investments.

Connect

No Offer of Securities—Disclosure of Interests Under no circumstances should any material at this site be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they can evaluate the merits and risks of prospective investments.

© 2024 5D's Capital Partners. All Rights Reserved